Zambia’s new government will seek to ease investor concerns about how it will return the southern African nation to debt sustainability and economic growth in Finance Minister Situmbeko Musokotwane’s budget on Friday.

Since it became Africa’s first pandemic-era sovereign defaulter almost a year ago, little progress has been made on restoring normal relations with creditors, while interest arrears that in June had already surpassed $470 million keep piling up. Total sovereign debt is now $13.4 billion.

President Hakainde Hichilema is hoping to win an endorsement from the International Monetary Fund for his economic recovery plan, which should come with a $1.3 billion loan. That’s expected to spur debt restructuring talks.

These charts show what Musokotwane faces as he prepares to deliver his speech at about 2:15 p.m. in Lusaka, the capital.

Copper Boost

The rally in copper prices is good news for Zambia, the continent’s second-biggest producer of the metal. It depends on copper for more than 70% of export earnings.

The minister will probably announce changes to mining taxes as he seeks to encourage a doubling of production over the next five years. Royalties might drop, and become deductible from income tax — a key request from the mining industry. First Quantum Minerals Ltd., which accounts for more than half of Zambia’s output, stands to benefit.

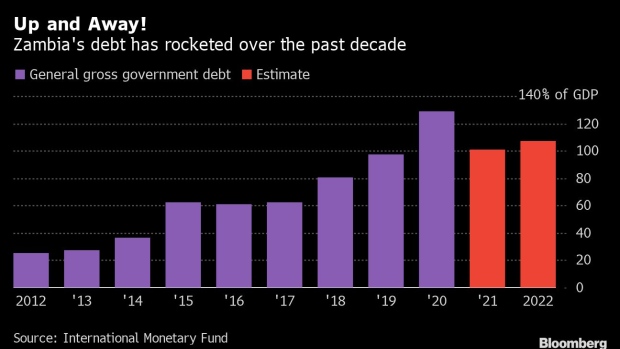

Decade of Debt

A raft of new loans from Chinese banks to Eurobonds had already pushed the government close to default even before the pandemic tipped it over the edge. Talks with the IMF have centered on how to bring the liabilities back to sustainable levels.

The government will soon start negotiations with creditors, including the holders of its $3 billion in foreign-currency bonds, to extend loan maturities and reduce interest rates. The minister will give a detailed update to creditors on the IMF talks and next steps in the restructuring process on Nov. 2.

Investors will be eager to see credible plans in the budget after repeated spending blowouts in recent years. Barclays Plc forecasts a fiscal deficit of 8.3% of gross domestic product for 2021, narrowing to 7% next year, economist Michael Kafe wrote in a note Thursday.

Double Digits

The government and central bank have struggled to keep inflation in check, and it was last in the 6% to 8% target band in April 2019. October consumer prices increased by 21.1% compared with a year ago.

Still, inflation probably peaked in June and a rebound in the local currency since Hichilema won the presidency in August should help keep prices in check.

Denny Kalyalya, who this month returned to head the Bank of Zambia, has repeatedly said that fiscal authorities need to play a bigger role in reining in inflation.

Driving Growth

The budget will also set out how the government plans to boost economic growth, which is central to the strategy to exit the debt crisis.

Musokotwane has stressed that his focus will be to drive growth in order to boost government revenue and create jobs. Expansion has slowed over the past decade and the economy contracted last year for the first time since 1998.

“Let’s raise production,” he said at his first interview — with the national broadcaster — after being appointed to the post. “That’s what creates wealth.”

IMF to the Rescue

While the IMF will help set the parameters for Zambia’s debt restructuring, the Washington-based lender will also further bolster Zambia’s foreign-exchange reserves that plunged to record-low levels.

The lack of reserves had added to pressure on Zambia’s kwacha. The country’s $1.3 billion share of the IMF allocation for low-income countries to cope with Covid-19 helped lift reserves to the highest in nearly six years.

The sought-after loan program would add another $1.3 billion to the state’s coffers.

Source: Bloomberg L.P.