[ad_1]

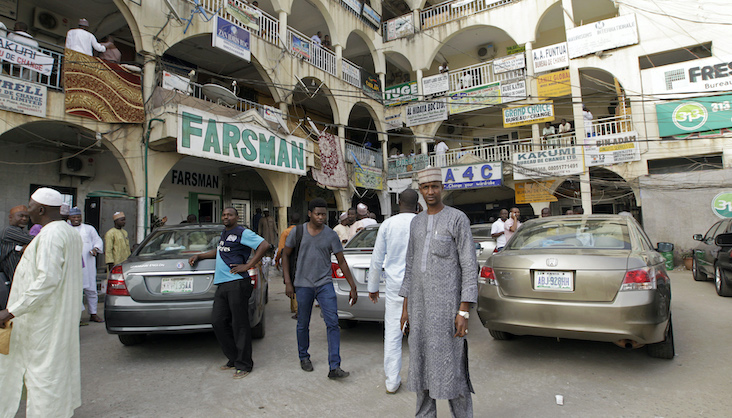

Several bureau de change officials at the popular Wuse Zone 4 area of Abuja, the biggest black market in Abuja, told The Africa Report that the euro was too unstable and they wanted to avoid incurring any losses.

The few who are willing to buy euros were doing so at a value price in order to protect themselves from losses.

Below parity

The euro briefly fell below parity with the US dollar for the first time in 20 years during the week of 11 July. In Nigeria, while the greenback was being sold for about N615 on the parallel market, the euro was pegged at N610 on Thursday 14 July. On Friday, many traders had stopped trading the euro altogether.

“We are not buying or selling euros at this time. It is too unstable,” said a cashier at 313 Bureau de Change, one of the biggest bureau de change firms in Abuja.

Another operator also told The Africa Report that many expatriates and diplomats had been converting their euros to dollars in order to protect themselves from any losses in the past week.

“Many of my customers that earn in euros started converting their money to dollars last week. I don’t see things changing until early September when many Nigerian students schooling in Europe will need to pay school fees. The demand for euro will certainly rise by then. Maybe we will start trading by then if the Europe crisis doesn’t change,” said another operator.

A word from the president

Aminu Gwadabe, the president of the Association of Bureau De Change Operators of Nigeria, told The Africa Report on Friday 15 July that some of his members were still trading euros.

Gwadade, however, added that the currency had become unstable and the demand for it had fallen, hence the decision of many operators to avoid the currency.

The “euro fluctuates very fast. And the demand is very low in Nigeria. So, a lot of people hardly ever want to buy it and lose money. It is a high risk. You may end up losing because it is too volatile. The crisis in Europe is also causing problems. All these things put together are contributing to [currency fluctuation]. However, I still have some members who are trading in euros,” he said.

Crisis management

Economist Muda Yusuf, who is a former director-general of the Lagos Chamber of Commerce and Industry, told The Africa Report that the bureau de change operators are protecting themselves.

“You don’t want to expose yourself to a currency that is volatile and is operating in an unpredictable situation because the risk is high. They can buy now and it will crash. And then they will be forced to sell at a loss. Refusing to buy is simply a risk-management mindset, which is not bad,” he said.

There is widespread concerns about a potential recession in Europe in part due to a looming energy crisis. Russia is threatening to suspend gas flows to Europe in retaliation for EU sanctions since the invasion of Ukraine.

[ad_2]

Source link