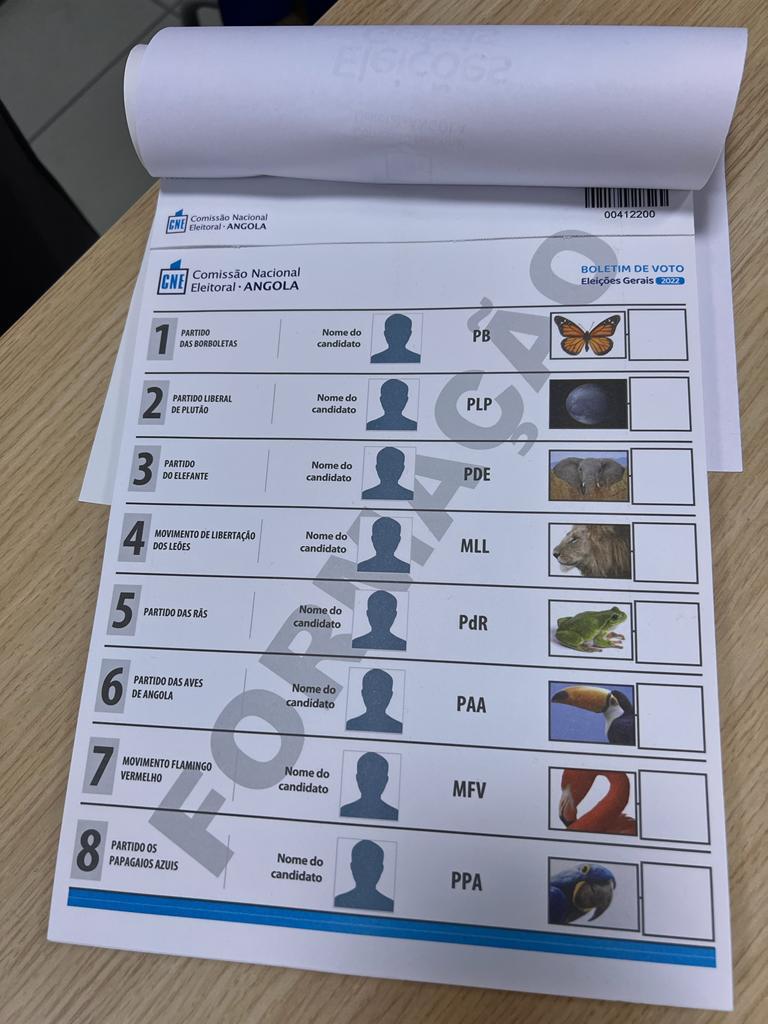

Currently, Angolans are voting for a new president and parliament in what appears to be the most competitive election in Africa’s second-largest oil producer since 1975, since Angola gained independence from Portugal. The election results could herald a more competitive age in Angolan politics, which would be of interest to all Angolans. Up until this point, President Lourenço and the MPLA party are being challenged by an opposition alliance that has been energized by economic hardship.

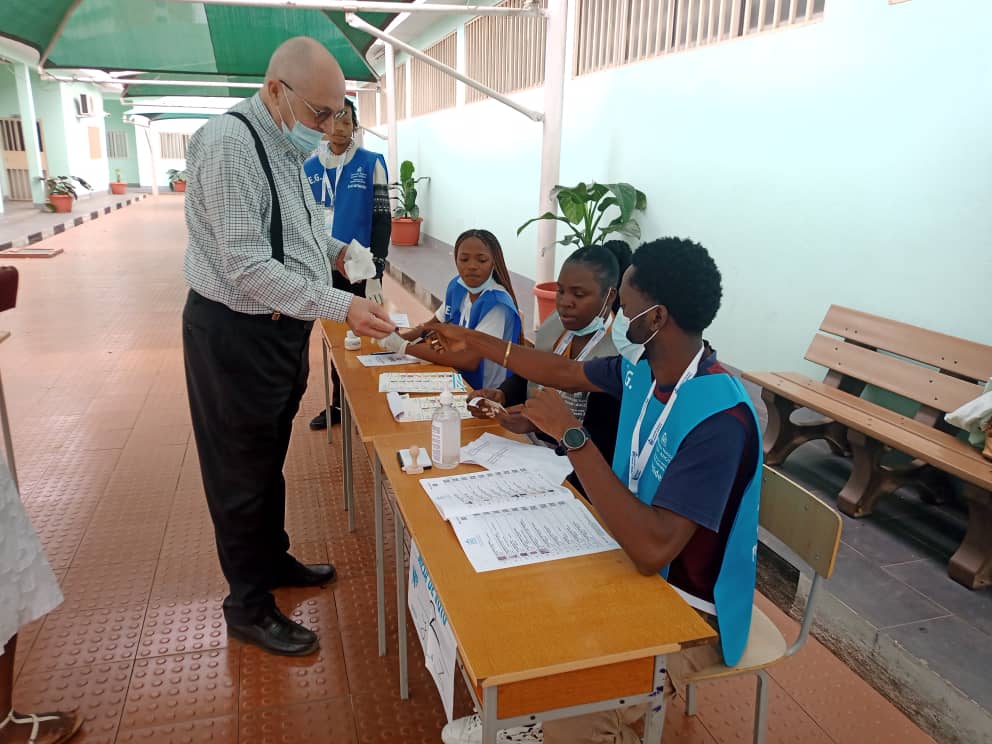

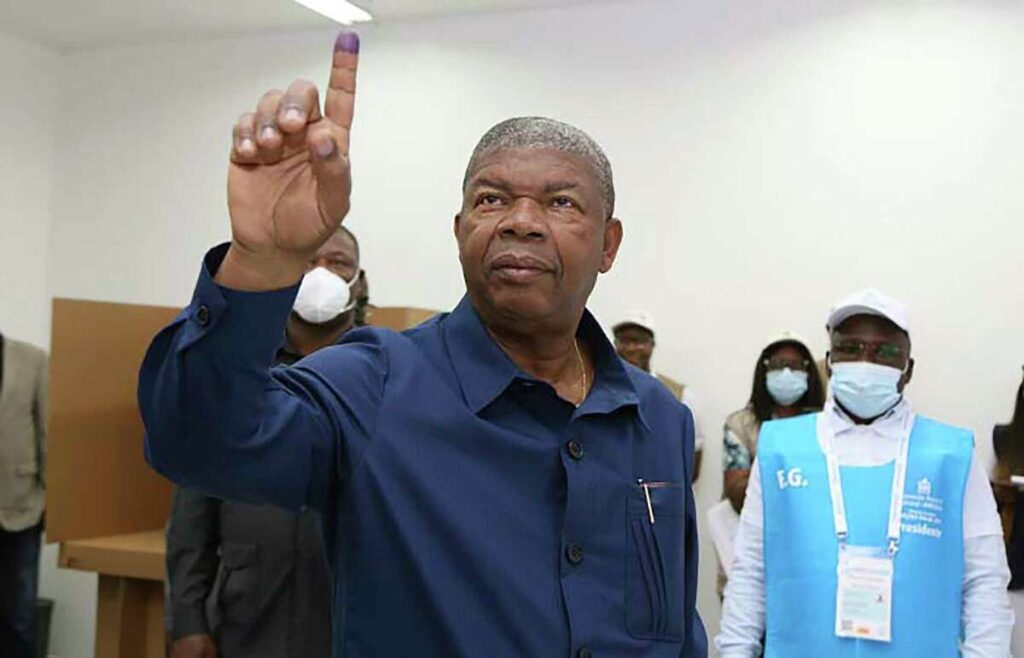

Earlier today, President Joao Lourenco cast his ballot at Universidade Lusiada de Angola, Located at Largo do Lumeji 11/13 Maianga District. A simple accreditation and voting system is still taking place in most centers, and the street remains peaceful, albeit with a steady influx of voters at the polling grounds.

Since assuming office in 2017, President Joo Lourenço of the governing MPLA has prioritized rebuilding the corrupt southern African nation. However, he is competing against Adalberto Costa Júnior of the opposition National Union for the Total Independence of Angola (UNITA).

One of Africa’s largest economies is Angola. According to OPEC, it is the second-largest oil producer on the continent after Nigeria, and according to Kimberley Process data, it is the seventh-largest producer of rough diamonds worldwide. Additionally, Lourenço, in his first term in office has launched anti-corruption investigations via the MPLA leadership.

For the country and for investors, there is a lot at stake. The economic landscape of Angola is in a delicate balance, as citizens want an improved condition of living and better opportunities.

The World Bank reports that Angola’s GDP climbed 0.7% in 2021 following five years of recession, and the finance minister anticipates growth of 2.7% this year. While decreasing, inflation is still above 20%.

Investors are pricing in a victory and a majority of the 220 parliamentary seats for the MPLA, which would mean the continuation of Lourenço’s market-friendly policies, for the country’s $9 billion in outstanding Eurobonds.

This year, the economy is anticipated to grow at a solid rate as domestic demand is boosted by fewer COVID-19 regulations. Additionally, rising energy prices brought on by the impact of the conflict in Ukraine should stimulate economic growth even more. The Angolan kwanza is expected to exert some downward pressure on inflation and provide the local economy another boost as oil prices rise and demand increases.

Although the opposition is determined to win in a coalition with others, the incumbent appears to be favored and likely to win a second term. We are awaiting the results of the countrywide elections. If something goes wrong, the nation could experience severe economic issues.