[ad_1]

A report by the country’s statistical agency shows increased inflation for several services including transport, household maintenance and water and gas prices.

Bread prices saw a 44.5% year-on-year price increase. The price of imported rice increased by 28.7%, leading to increasing levels of food insecurity among the poorest households. Diesel and other fuels have also increased in response to global shortages caused by the war in Ukraine.

Ghana’s government made an U-turn and started talks with the International Monetary Fund for potential support on 1 July, as the continent struggles with the impacts of Covid-19 and the Ukraine crisis.

17th’s times a charm?

According to a finance ministry spokesperson speaking to Reuters, a mid-term budget review scheduled for Wednesday 14 July has been postponed due to the IMF talks. The IMF conducted a visit to assess Ghana’s economic situation on 6-13 July.

Of the trip, the IMF’s Carlo Sdralevich said: “Investors’ concerns have triggered credit rating downgrades, capital outflows, loss of external market access and rising domestic borrowing costs.”

He continued: “The IMF team held initial discussions on a comprehensive reform package to restore macroeconomic stability and anchor debt sustainability.” No agreement has yet been made on a definitive agreement.

This is the 17th time the country has turned to the organisation for help, asking for a bailout which is expected to be approximately $1.5bn.

#FixtheCountry, an activist organisation that advocates for government transparency, released a statement regarding the potential IMF bailout. It said: “There is no indication that the government has learnt any lessons or is motivated to stem the cycle of excessive borrowing and debt pile up.”

It continued: “We are thus concerned that the cyclical recourse to the IMF has become an entrenched part of economic policy in Ghana and that the country continues to treat excessive debt and the IMF as a get-out-of-jail card without any regard for the noted externalities on social welfare and long-term economic certainty.”

Dealing with debt

The country’s total debt remains at more than two-thirds of its GDP.

Mark Bohlund, a senior credit research analyst for REDD Intelligence, argues that central bank financing may be one of the problems causing the country’s economic problems. He said: “While the cedi has weakened since January, the increase in prices has been considerably larger than in previous episodes of currency weakness in Ghana. It is still unclear exactly what the reason for this is, but central bank financing of the government’s operations is one potential cause.”

He continued: “If there has been substantial central bank financing in 2Q22, then it would decrease the likelihood that Ghana will be able to clinch another IMF program before such issues have been addressed.”

Speaking up

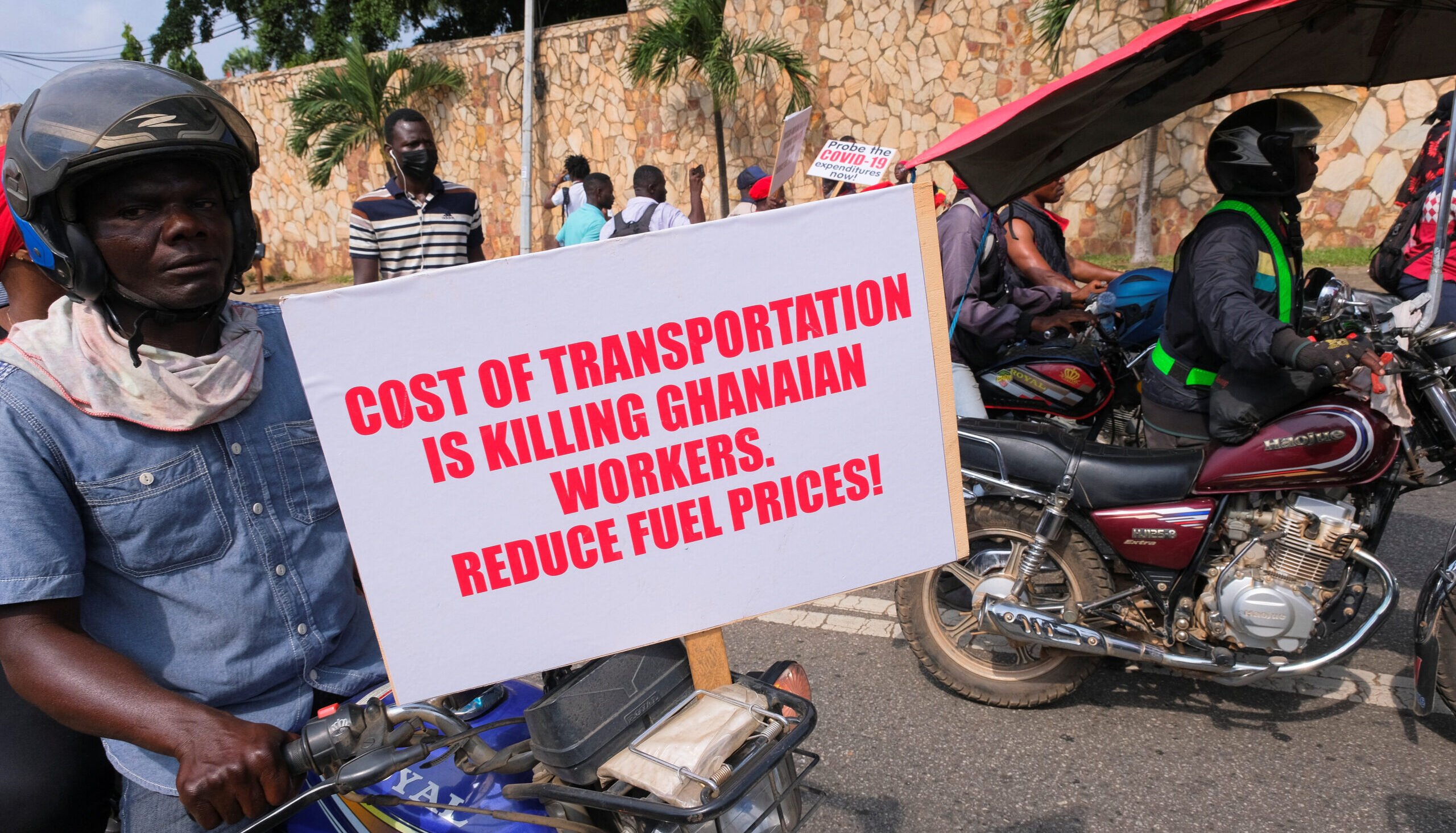

Protests in Accra last month were widely publicised, as people took to the streets to complain about high inflation rates and controversial government policies such as the e-levy on digital transactions.

Pressure from civil society is likely to mount. Half of the country’s public-sector workers have declared strikes over the cost of living, with several of Ghana’s teachers’ unions announcing that they would conduct mass strikes if wages did not rise to meet rising living costs.

[ad_2]

Source link